Prevailing Wage Log To Payroll Xls Workbook : Certified Payroll Form - Page 1 (WH347) | Payroll, Wage ... : Prevailing wage log to payroll xls workbook / payrolls office com.

Prevailing Wage Log To Payroll Xls Workbook : Certified Payroll Form - Page 1 (WH347) | Payroll, Wage ... : Prevailing wage log to payroll xls workbook / payrolls office com.. What are prevailing wage laws and how do they work in construction? Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. I certify that the above information represents the wages and supplemental benefits paid to all. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. Prevailing wages are rates of pay established by the u.s.

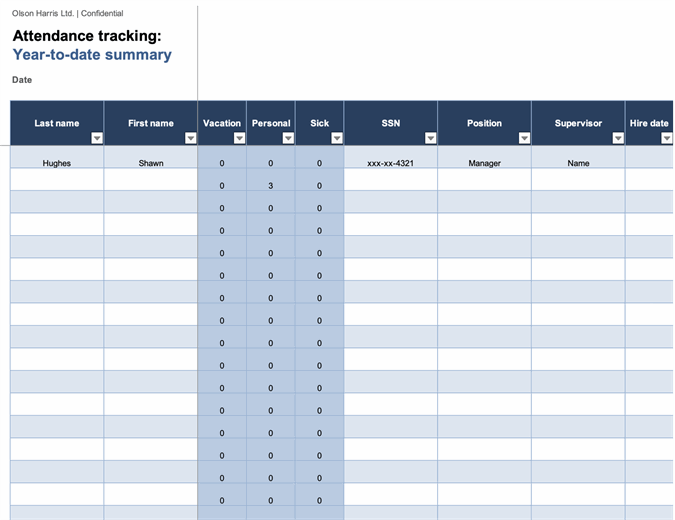

Create a payroll report template with a graphical view of data to engage viewers and highlight important data. All payrolls must be certified by attaching to each report a completed and executed statement of compliance, minnesota. I certify that the above information represents the wages and supplemental benefits paid to all. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. What are prevailing wage laws and how do they work in construction?

Number of days to accrue f.

Please complete this form and mail or fax to: Includes pay stubs, timesheets, a payroll register template, and more. A dashboard allows you to get a quick overview of payroll metrics, compiling a range of information into a single. Department of labor (and used by the connecticut department of labor) indicate specific amounts the state certified payroll forms may be downloaded from the department of labor, wage & workplace standards division website: Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. 0 ratings0% found this document useful (0 votes). Yes, all prevailing wage work must be done by contract. Prevailing wage master job classification. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. What is onduty as per employee compensation act. Prevailing wages are rates of pay established by the u.s. Enter total payroll for the employee to include the project and all other wages earned for the week. I certify that the above information represents the wages and supplemental benefits paid to all.

Forms used to process prevailing wages. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. The access version posted by abi_vas has a bug in the programme.

Use these free templates or examples to create the perfect professional document or project!

Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Prevailing wage log to payroll xls workbook / payrolls office com. When present, prevailing wage laws require that contractors and subcontractors on public jobs must when report on certified payroll, should all. Prevailing wage log to payroll xls workbook : Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Please complete this form and mail or fax to: fill in all blank items. A dashboard allows you to get a quick overview of payroll metrics, compiling a range of information into a single. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. Forms used to process prevailing wages. Includes pay stubs, timesheets, a payroll register template, and more.

Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format! Department of labor (and used by the connecticut department of labor) indicate specific amounts the state certified payroll forms may be downloaded from the department of labor, wage & workplace standards division website: The prevailing wage rate schedules developed by the u.s. They must report these wages on certified payroll reports. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes.

Yes, all prevailing wage work must be done by contract.

fill in all blank items. Use these free templates or examples to create the perfect professional document or project! Includes pay stubs, timesheets, a payroll register template, and more. What are the procedure for esi non implemented area. Enter total payroll for the employee to include the project and all other wages earned for the week. Days in payroll period e. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Prevailing wage log to payroll xls workbook / payrolls office com. Prevailing wage master job classification. Reviewing prevailing wage dba range. Number of days to accrue f. Prevailing wages are rates of pay established by the u.s. To get the proper rates for your region/job, you must request a determination.

Komentar

Posting Komentar